Rpgt Rate Malaysia 2019

Here s a walk through of rpgt through the years and what you need to know today.

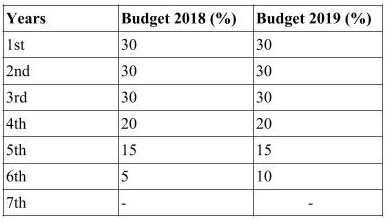

Rpgt rate malaysia 2019. As you can see from the above rpgt rates from the 6th year onwards have increased to twice the existing rates for all the 3 tiers. For example if you bought an apartment for rm 250 000 and decided to sell it for rm 500 000 the profit of rm 250 000 is chargeable under rpgt. Now there s about to be another revision to the rpgt for 2020. Rpgt rates in malaysia were adjusted in budget 2019 with new changes announced as part of budget 2020.

Maximize your returns and minimize costs risks when selling property in malaysia. Rpgt act through the years 1976 2019. Learn about malaysia s property stamp duty and real property gains tax rpgt in 2019. There s no time to stand still when it comes to rpgt in malaysia it seems.

As you can see from the above example david saved about rm7 500. It includes both residential and commercial properties estates and empty plot of lands. Rpgt rm300 000 x 5 rpgt rate for 6th year onwards rm15 000. See the tables below for the tax rates.

In 2014 the rpgt was increased for the fifth straight year since 2009. Where the purchase consideration consists wholly or partly of cash the acquirer is required to withhold the lower of the entire cash consideration or 3 of the total acquisition price 7 where the disposer is not a citizen and not a permanent resident or not a company incorporated in malaysia w e f. Now here is some history about the rpgt. New rpgt rates from 1 january 2019.

Rpgt rpgt calculation chargeable gain disposal price. Rpgt payable nett chargeable gain x rpgt rate for example if you bought a house for rm250k and sell it at rm350k the profit of rm100k is chargeable under rpgt but you may be entitled to deduct expenses such as legal fees agency commission and renovation cost with proof of receipt and subject to lembaga hasil dalam negeri lhdn approval in order to get the nett chargeable gain. We ve got your back. Fast forward to 2019 the rpgt rates have been revised.

The most recent rpgt amendment to be implemented in 2019 will be the seventh one so far. The date the relevant law comes into effect. Below are the rpgt rates for each of the 3 tiers for your perusal. Finally your tax rate will be determined by the holding period which is the number of years you have owned the property.

Rm650 000 rm500 000 based on market price on 1st january 2013 rm150 000. Rm15000 rm7500 rm7500 saving that s a. It was suspended temporarily in april 2007 to december 2009 and reintroduced in 2010. Rpgt is a tax imposed on gains derived from disposal of properties in malaysia.